income tax rates 2022 south africa

73726 31 of taxable income above 353100. For Individuals Trust.

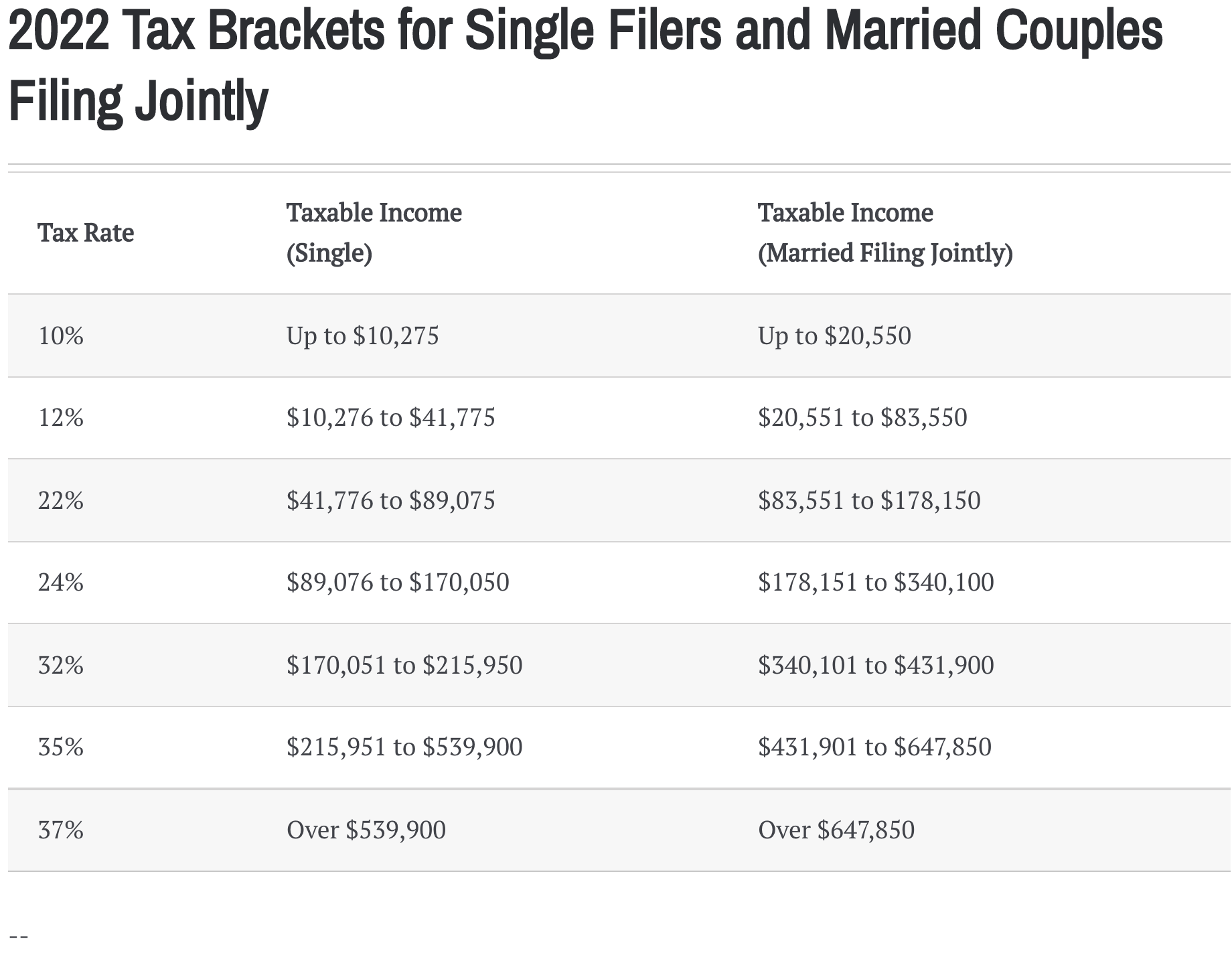

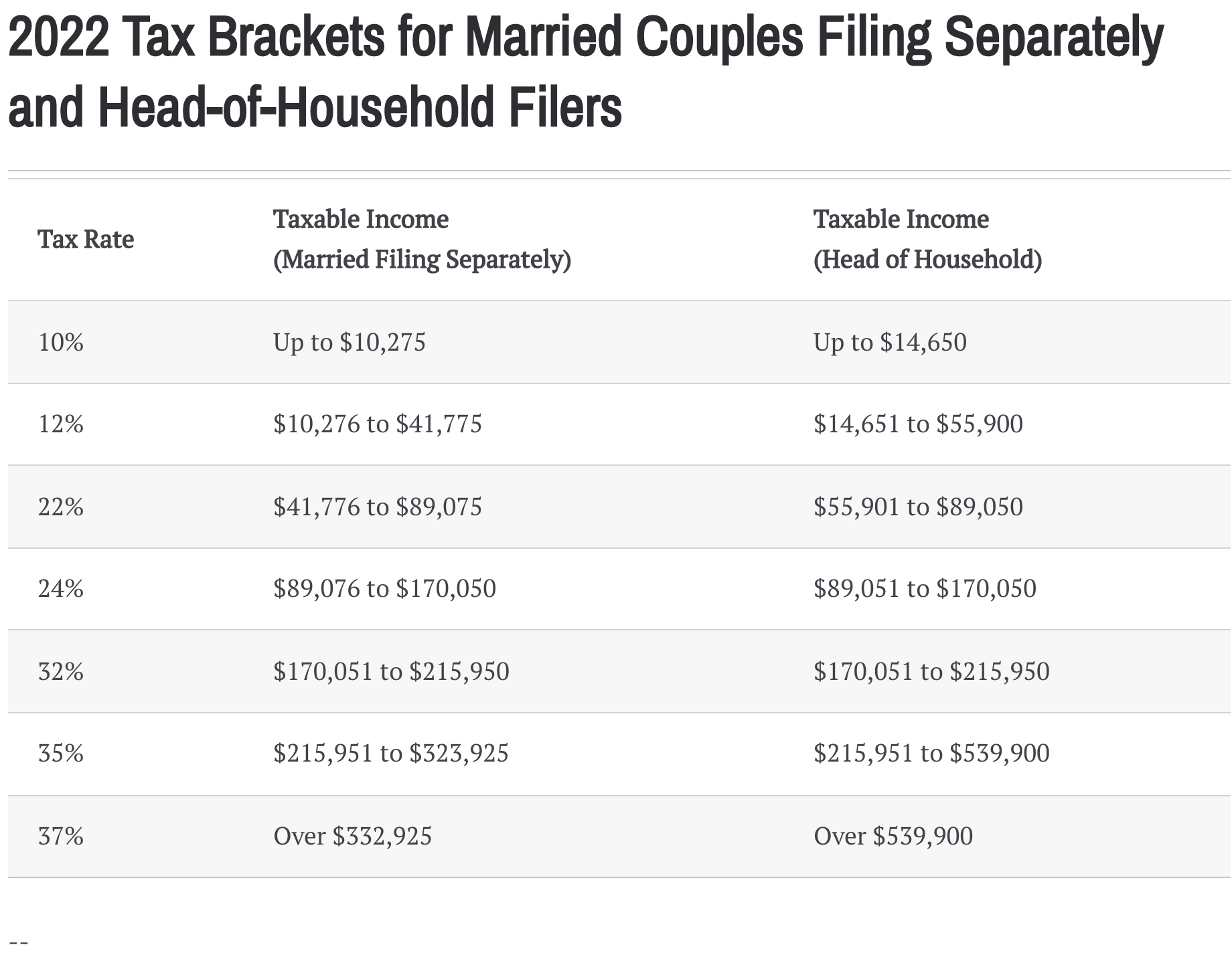

Income Tax Brackets For 2022 Are Set

40680 26 of taxable income above 226000.

. Taxable Income R Rates of Tax. For taxpayers aged 75 years and older this threshold is R151 100. Information is recorded from current tax year to oldest eg.

18 of taxable income. Depreciation allowances also referred to as wear-and-tear allowances are granted by SARS for certain qualifying assets. You are viewing the income tax rates thresholds and allowances for the 2022 Tax Year in South Africa.

Income Tax Rates and Thresholds. Personal income tax rates Local income taxes There are no local income taxes in South Africa. 2021 and 2022 tax years.

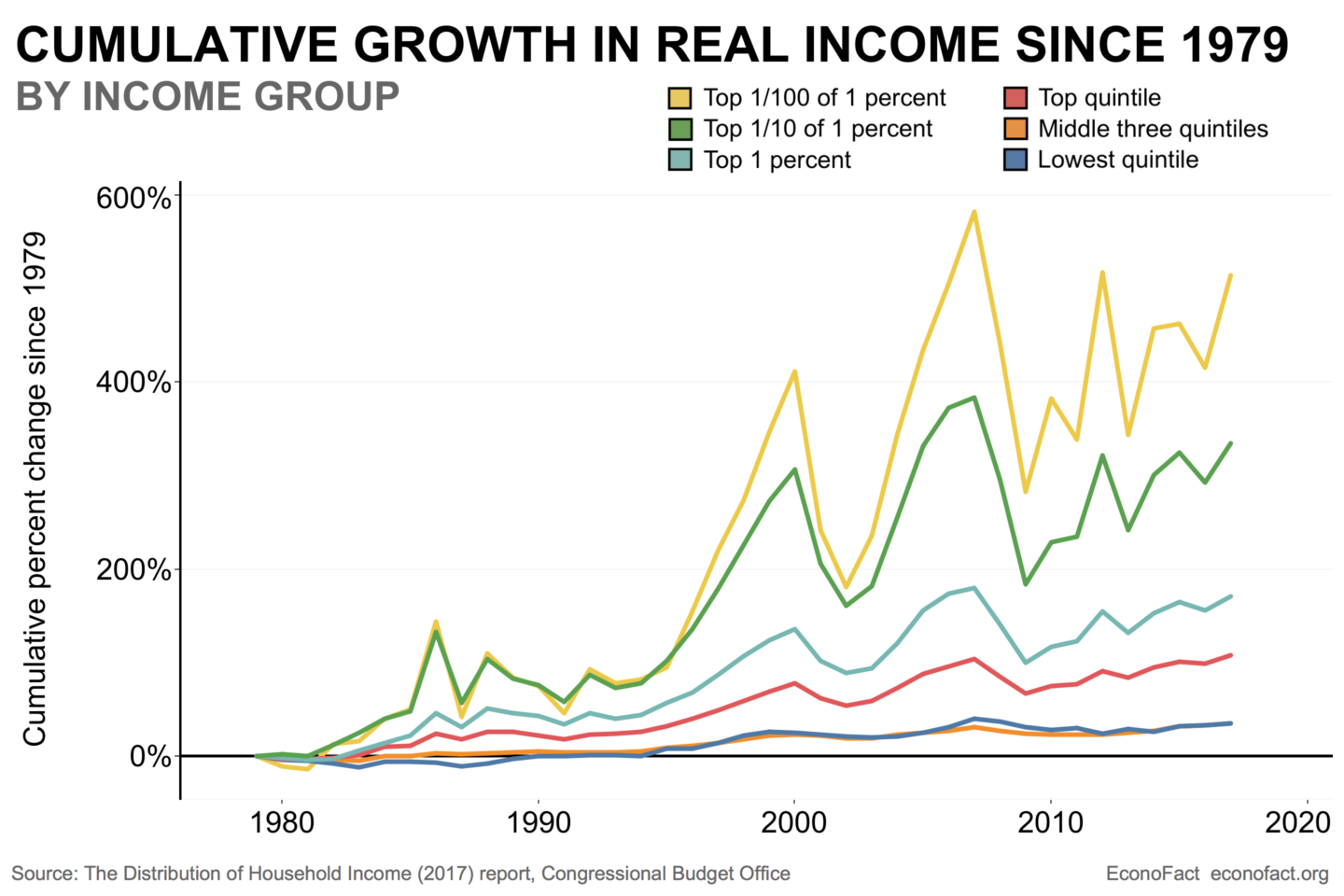

Taxable income Rates of tax. Effects of reduced corporate income tax rate on investors in REITs. Discover Helpful Information and Resources on Taxes From AARP.

Capital Gains Tax CGT See here how the changes in tax rates affect the age groups per income level from last year to this year. Taxable income R Rates of tax. For more information on tax rates see the Budget webpage.

Businesses and depreciation allowances. 2023 2022 2021 2020 2019 2018 2017 2016 2015 etc. 40680 26 of taxable income above 226000.

Your 2021 Tax Bracket to See Whats Been Adjusted. Tax rates are proposed by the Minister of Finance in the annual Budget Speech and fixed or passed by Parliament each year. 8 rows Tax rates for the year of assessment.

South africa income tax calculators 201819. Effects of reduced corporate income tax rate on investors in REITs February 10 2022 The Minister of Finance in February 2021 announced that the corporate income tax rate would be reduced to 27 from 28 for companies with years of assessment beginning on or after 1 April 2022. 2021 and 2022 tax years.

The corporate income tax rate has been reduced from 28 to 27. Fuel prices have skyrocketed over the past year in South Africa and petrol looks set to breach the R21litre mark in March. 2022 Tax Rates Thresholds and Allowance for Individuals Companies Trusts and Small Business Corporations SBC in South Africa.

Personal Income Tax Rate in South Africa is expected to reach 4500 percent by the end of 2020 according to Trading Economics global macro models and analysts expectations. 18 of taxable income 226001 - 353100. Tax rates for the year of assessment.

The rates for the tax year commencing on 1 March 2022 and ending on 28 February 2023 are as follows. Tax rates year of assessment ending 28. Quick Tax Guide South Africa 2122 Individuals Tax Rates and Rebates Individuals Estates Special Trusts 1 Year ending 28 February 2022 Taxable income Rate of tax R0 R216 200 18 of taxable income R216 201 R337 800 R38 916 26 of taxable income above R216 200.

Tax rates from 1 March 2021 to 28 February 2022. 7 rows 23 February 2022 See the changes from the previous year. South Africa Personal Income Tax Rate - values historical data and charts - was last updated on May of 2022.

If you are 65 years of age to below 75 years the tax threshold ie. 18 of taxable income 226001 - 353100. Information is recorded from current tax year to oldest eg.

2021 and 2022 tax years. The incandescent light bulb levy will be increased. If you are looking for an alternative tax year please select one below.

Use our free online income tax calculator to work out your monthly take-home pay and view the income tax tables for individuals for the 2023 tax year. The lower tax will take effect for companies with a tax year ending on or after 31 March 2023. The below table shows the personal income tax rates from 1 march 2021 to 28 february 2022 for individuals and trusts in south africa.

In this section you will find the tax rates for the past few years for. News April 2022 By Pyper Turner. Contacts News Print Search.

2022 2023 Tax Year. Taxable Income R Rate of Tax R 1 91 250 0 of taxable income 91 251 365 000 7 of taxable income above 91 250 365 001 550 000 19 163 21 of taxable income above 365 000 550 001 and above 58 013 28 of the amount above 550 000. Years of assessment ending on any date between 1 April 2022 and 30 March 2023.

The result is a substantial tax debt which can often not be settled in. The PAYE Dangers and a New Option for Pensioners. A nightmare situation for many South African taxpayers is discovering after their year-end tax assessment that the PAYE they paid on various income streams during the year was not enough.

2023 2022 2021 2020 2019 2018 2017 2016 2015 etc. Quick Tax Guide South Africa 2122 Individuals Tax Rates and Rebates Individuals Estates Special Trusts 1 Year ending 28 February 2022 Taxable income Rate of tax R0 R216 200 18 of taxable income R216 201 R337 800 R38 916 26 of taxable income above R216 200. The amount above which income tax becomes payable is R135 150.

2022 2023 Tax Year. You are viewing the income tax rates thresholds and allowances for the 2022 Tax Year in South Africa. In the 2021 budget speech the former finance minister announced that the corporate income tax rate would be reduced by one percentage point to 27 for companies with a year of assessment commencing on or after 1 April 2022.

Tax Rates year of assessment ending 28 February 2022 TaxThresholds Age Threshold Below age 65 R87 300 Age 65 to below 75 R135 150 Age 75 and older R151 100 Trusts other than special trusts will be taxed at a flat rate of 45. Dailystarcoza Sars definitely improving their service they have realised there is a mad rush once the tax season starts so they have started early with their notifications. However the rate reduction has yet to be enacted.

2023 tax year 1 March 2022 - 28 February 2023 Taxable income R Rates of tax R 1 - 226000. For the 2022 year of assessment 1 March 2021 28 February 2022 R87 300 if you are younger than 65 years. 0 - 188 000.

Ad Compare Your 2022 Tax Bracket vs. 7 rows South Africa Residents Income Tax Tables in 2022. The below table shows the personal income tax rates from 1 March 2022 to 28 February 2023 for individuals and trusts in South Africa.

Ms Excel Consulting Price Worksheet Template Everyday Word Excel Templates Word Template Worksheets Excel Templates

1 15 5 G1 Gross Income Vs Net Incomeevan Earns 1600 00 Personal Financial Literacy Financial Literacy Income

Fed Funds Historical Interest Rate Hike Chart Can Your Finances Withstand An Interest Rate Hike Or Two Interest Rate Hike Interest Rates Rate

Poorest Countries In The World Vivid Maps Map Global Poverty Poor Countries

Ms Excel Consulting Price Worksheet Template Everyday Word Excel Templates Word Template Worksheets Excel Templates

Truworths Account Review Moneytoday In 2022 Accounting Retail Fashion Credit Facility

When Do You Need An Accountant Accounting Do You Need Ppt Presentation

Pdf All About Money Economics Business Pdf Thinking Tree Books Economics Project Cover Page Business And Economics

How To File Your Income Taxes In South Africa Expatica

Nice Map Of Vanderbijlpark Amazing Maps Map Circular Pattern

Income Tax Rates For The Self Employed 2020 2021 Turbotax Canada Tips

Income Tax Brackets For 2022 Are Set

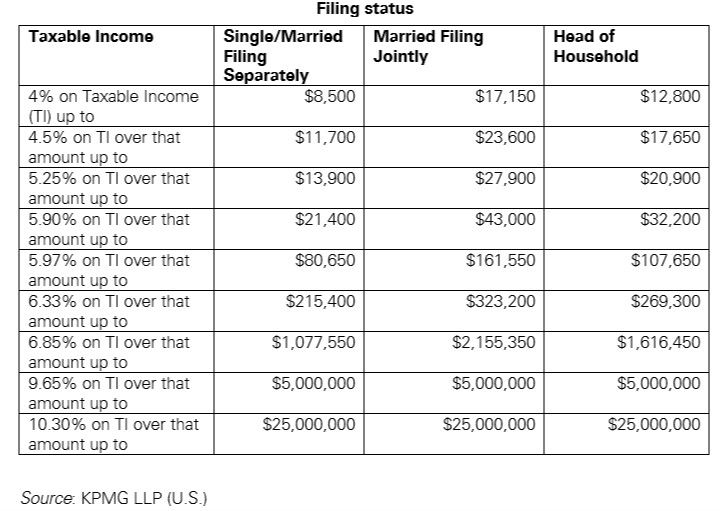

Us New York Implements New Tax Rates Kpmg Global

Easyproperties How Does It Work With Ceo Rupert Finnemore In 2022 Investing Safe Investments Real Estate Investment Trust